Supporting Somalia’s Economic Recovery through Inclusive Financial Services

September 24, 2025

Established in 2014 with support from Innovest’s Managing Director, Justin Sykes, KIMS Microfinance has grown in a little over a decade from a start-up to becoming Somalia’s largest non-banking financial institution. KIMS operates 9 branches, maintains a gross loan portfolio of $3.1 million, and serves over 4,900 active clients with a Portfolio at Risk (>30 days) of just 1.56%.

Since inception, the institution has disbursed 47,000 shariah-complaint micro and small enterprise (MSE) loans with a value of more than $47 million and is estimated to have created and sustained over 40,000 jobs.

Innovest currently provides management strengthening support to KIMS, assistance with donor and investor relations and strategic partnership identification, and impact measurement and reporting support, while Justin Sykes serves as a non-executive director on the Board of KIMS.

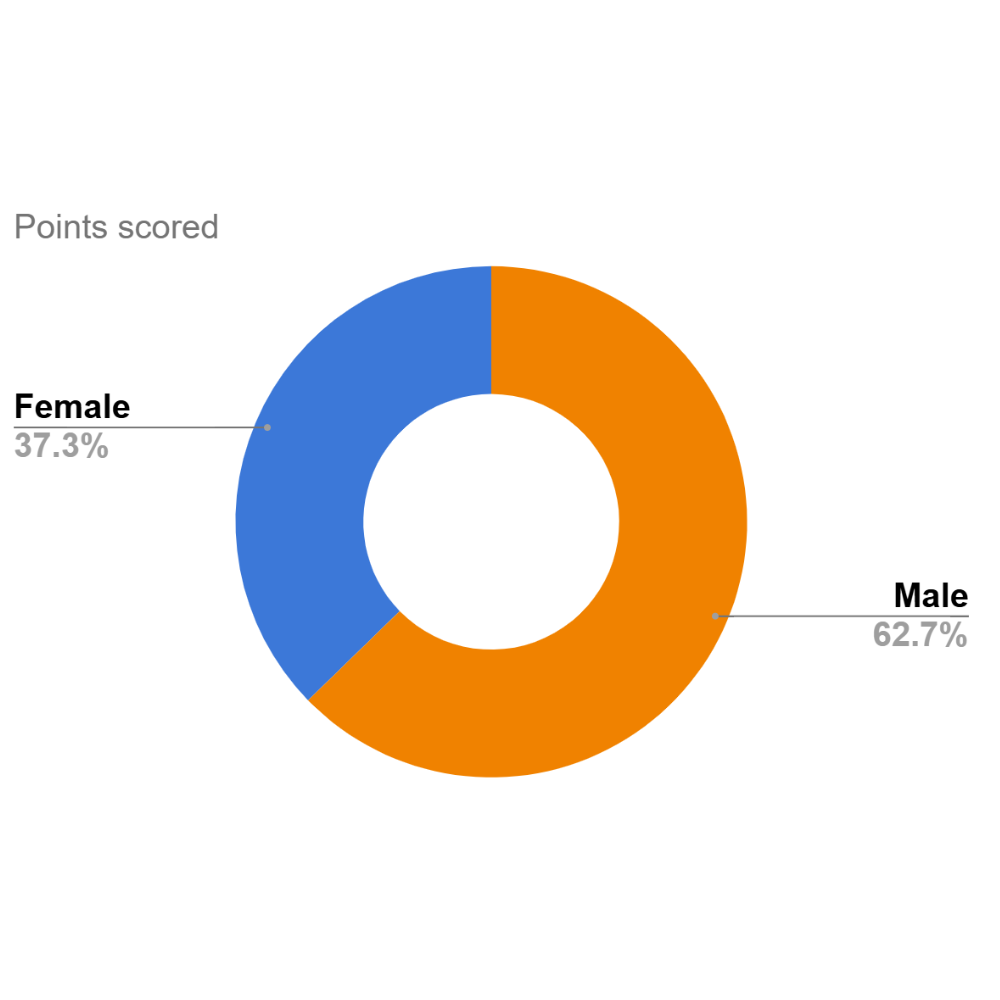

KIMS operates a pro-poor business model with its enterprise financing contributing to stability and post-war economic recovery. KIMS prioritises support to women (40% of the client base) and youth (50% of the client base) owned MSEs, and furthermore, over 25% of its client base have experienced displacement (refugee returnees, refugees and IDPs) as a result of political conflict, natural disaster or climate change. Innovative financing solutions are central to KIMS’ impact.

KIMS is committed to ensuring access to finance for some of the most vulnerable communities through appropriately designed products and services. KIMS has introduced a number of innovative loan products which are quickly scaling after proof of concepts.

One such example is the “Khadejah” loan scheme, dedicated to growth focussed female entrepreneurs, designed based on the challenge female business owners face in accessing first time MSE finance. Since launching at the end of 2024 the scheme has served 575 borrowers with $396,000 disbursed. This portfolio is projected to grow significantly in the coming years providing over 2,000 loans for a total amount of over $1 million by the end of 2028, with the backing of dedicated impact investors, led by Whole Foods Foundation.

A second example of market-driven product development has been the institution’s solar loan initiative. Somalia faces some of the highest energy costs in the world, with electricity priced at up to $1 per kilowatt-hour, five times that of neighboring Kenya. Solar home systems offer cheaper and cleaner forms of electricity for low-income Somalia households as well as a range of other benefits, including increased nighttime security and increased productive hours. However, limited ability of high-quality and appropriate solar systems and no scaling loan financing schemes have restricted households’ ability to shift to solar.

KIMS sought to change this through pilot operated in 2024-2025 which financed solar systems for over 1,000 households and MSEs. A survey of the clients of this pilot showed that it was providing some of the most meaningful positive impacts of any solar home system initiative across Africa.

Building on this positive news, and with the support of a $1 million investment from Acumen’s Hardest to Reach Fund, KIMS is set to scale its solar solutions, aiming to deliver solar access to 8,190 clients nationwide by the end of 2027.

Most recently, Innovest has worked with KIMS to complete a robust impact data collection and verification exercise. Innovest Advisory collected data from 370 respondents (8% of active borrowers) across Somalia, with over 50% women represented, to reveal that KIMS is broadening its impact by increasing first-time finance access from 16% in 2022 to 24% in 2024 and by nearly doubling support for early-stage entrepreneurs (businesses operating for less than a year rising from 7% to 13%).

Additionally, 83% of clients reported that KIMS’ loans are vital for business continuity, helping them achieve a 40% increase in revenues and contributing to a 40% growth in employment opportunities, thereby positively impacting household income and overall quality of life.

Key findings from this data have been published on the KIMS website and form insights as part of KIMS inaugural annual impact report.