Innovest Supports Business Resilience amongst its Social Enterprise Partners

May 11, 2020

Innovest recognises the current COVID-19 pandemic threatens an economic downturn not seen since the Great Depression. The International Labour Organisation (ILO) estimates that there could be 25 million jobs lost and additional losses in labour income could reach USD 3.4 trillion.

Emerging markets are set to bare the worst of these impacts. Foreign investors have pulled $83bn from emerging markets since the start of the crisis. Many small businesses, the engines of job creation in these markets, already operate at the margins of social protection, and will likely be the most impacted by the COVID-19 crisis negatively.

Through this severe crisis, Innovest Advisory is continuing its support to create and scale sustainable market-based solutions to development challenges aligned with the United Nations Sustainable Development Goals (SDGs), supporting small business resilience.

Innovest works with a broad range of remarkable social enterprises in emerging markets who are having a catalytic impact on the lives of vulnerable populations in developing countries. These businesses include:

Pawame works to electrify and connect the African continent by offering affordable, reliable solar home systems on pay-as-you-go financing. Currently, Pawame operates in 14 Kenyan counties, including in Kakuma refugee camp which houses 120,000 refugees. In the past 3 years, they have reached over 13,000 households and continue to expand their products and services to reach more underserved families

Sierra Agra Inc, Sierra Leone’s only commercial juicing company which supports 3,500 of the country’s poorest smallholder farmers as an exporter of tropical fruit juice products to EU and North American markets. Their latest initiative, Project 10,000, vertically integrates with farming supply chains to pay village-level farmers greater and more reliable incomes.

KIMS Microfinance, which is the Somali market leader in providing sharia compliant microfinance services. Since 2014, KIMS has disbursed over $18m in financing to 18,200 clients. KIMS aims to enhance local economic development in Somalia by providing high-quality diversified microfinance services to low-income, economically active youth, women, displaced and rural communities, offering savings, microenterprise and SME financing. KIMS combines professional service delivery with competitive pricing, innovative products and supplementary non-financial services.

These businesses, whose core business models focus on providing quality products, services and employment for vulnerable, underserved populations, are now exposed to the economic and health impacts of COVID-19. They have shown great business resilience in developing and implementing response plans.

Pawame has wasted no time in implementing a COVID-19 Response Plan, built around the objective of “Keeping our business, our people, and our customers healthy”. Since masks are now required in public places in Kenya to slow down the spread of COVID-19, Pawame collaborated with staff member, Davis Okoth, to produce masks for the Pawame network. Davis is a talented cloth designer and is currently helping Pawame to distribute “Pawame Davis Masks” to staff, sales agents and technicians along with guidance on how to best use and wear a mask.

Pawame has also set up hand washing stations in many of its county shops, alongside KomeshaCorona health guideline posters. At their Nairobi HQ, almost all staff work at home, with essential operational staff given alternatives to public transport and maintaining social distance in rearranged, segregated work stations.

Likewise, KIMS Microfinance have shown great business resilience in drafting a Covid-19 Response plan that assesses health risks to both staff and the enterprises they serve as well as the financial stress it will place on clients businesses and the overall microfinance company. This has resulted in mandatory mask wearing and social distancing practices by KIMS staff, the provision of hygiene advice to clients and an institutional decision to pause all new lending and consider the rescheduling of client payment instalments on a merit basis.

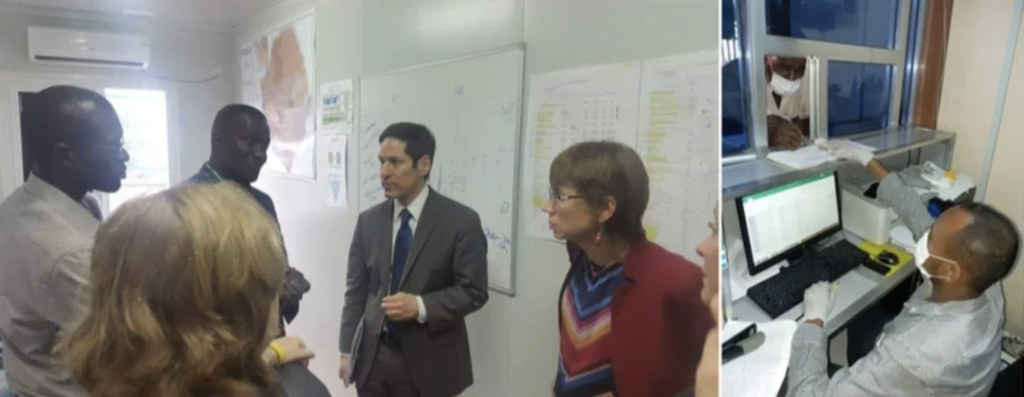

Sierra Agri Inc. has learned from the experience of struggling through the economic impacts of a pandemic, having been formed out of the collapse of a previous business Africa Felix Juices, which went bust in the 2004 Ebola crisis. Prior to joining Sierra Agra as a Board Director and CEO, Stephen Gaojia (pictured right) was the National Ebola Coordinator of Sierra Leone’s battle to end the spread of the disease. He has been recently met with President Bio and his cabinet to offer his insights on how to keep COVID-19 cases at minimum levels. Learning from these lessons Sierra Agra has instituted a social distancing policy at its juicing facility and among its 3,500 network of smallholder farmers. Sierra Leone as a whole has seen low incidence of COVID-19 due in part to the high degree of government and societal mobilisation given the countries experience with Ebola.

These are strong examples of our partners’ adaptability to transform operations demonstrating business resilience against the pandemic while continuing to offer vital services to vulnerable populations. However, with the prospect of a prolonged period of lockdown, social distancing and economic shocks in the areas they operate, these businesses are almost certainly going to need additional financial and technical support from the development and impact investment community.

With the right external support and leadership from the likes Pawame, KIMS and SAI , the social enterprise sector can weather this extended shock to continue serving marginalised clients through these unprecedented times.

Find out more about the work of Pawame, KIMS and SAI at their websites: